Published on Apr 3, 2012

CMNH Wildlife Specialist Michelle Leighty shares some fun facts about the humble turkey vulture.

Interesting large bird... Part of nature's clean up mechanisms... Think we have a nesting pair on Hines farm... :-) .... Monte & Eileen

Links:

Creature Feature: Turkey Vulture - YouTube

Turkey Vulture - Wikipedia, the free encyclopedia

BLOG PAGES

▼

May 18, 2013

May 17, 2013

American Farmer: The Heart of Our Country - Holistic Management for the People - INSPIRATIONAL AND DOABLE!!!

A short clip on Holistic Management featuring the stunning photography of Paul Mobley from his extraordinary book, "American Farmer".

www.welcomebooks.com/americanfarmer

www.paulmobleystudio.com

Holistic Management educator and rancher Brian Marshall talks about the global nature of Holistic Management and how it serves people and land no matter their differences.

We just pre-odered at AMAZON: http://tinyurl.com/dyoucvg HIGHLY RATED!!! .... Monte & Eileen

Holistic Management for the People - YouTube

Holistic Management for the People - YouTube

Genetically Modified Democracy: Monsanto and Congress Move to Stomp on States' Rights

By Ronnie Cummins

Organic Consumers Association, May 16th, 2013

Organic Consumers Association, May 16th, 2013

Reliable sources in Washington D.C. have informed the Organic Consumers Association (OCA) that Monsanto has begun secretly lobbying its Congressional allies to attach one or more “Monsanto Riders” or amendments to the 2013 Farm Bill that would preempt or prohibit states from requiring labels on genetically engineered (GE) foods.

In response to this blatant violation of states’ rights to legislate, and consumers’ right to know, the OCA and a nationwide alliance have launched a petition to put every member of Congress on notice: If you support any Farm Bill amendment that would nullify states’ rights to label genetically modified organisms (GMOs), we’ll vote – or throw – you out of office.

On Wednesday, May 15, an amendment to the House version of the Farm Bill, inserted under the guise of protecting interstate commerce, passed out of the House Agricultural Committee. If the King Amendment makes it into the final Farm Bill, it would take away states’ rights to pass laws governing the production or manufacture of any agricultural product, including food and animals raised for food, that is involved in interstate commerce. The amendment was proposed by Rep. Steve King (R-Iowa), largely in response to a California law stating that by 2015, California will allow only eggs to be sold from hens housed in cages specified by California. But policy analysts emphasize that the amendment, broadly and ambiguously written, could be used to prohibit or preempt any state GMO labeling or food safety law.

Will the King Amendment survive the Senate? No one can be sure, say analysts. However few doubt that Monsanto will give up. We can expect that more amendments and riders will be introduced into the Farm Bill--even if the King Amendment fails—over the next month in an attempt to stop the wave of state GMO labeling laws and initiatives moving forward in states like Washington, Vermont, Maine, Connecticut and others.

Monsanto and the Grocery Manufacturers Association (GMA) have admitted privately that they’ve “lost the battle” to stop GE food labeling at the state level, now that states are aggressively moving forward on labeling laws. On May 14, Maine’s House Ag Committee passed a GMO labeling law. On May 10, the Vermont House passed a labeling bill, 99-42, despite massive lobbying by Monsanto and threats to sue the state. And though Monsanto won a razor-thin victory (51 percent to 49 percent) in a costly, hard fought California GMO labeling ballot initiative last November, biotech and Big Food now realize that Washington State voters will likely pass I-522, an upcoming ballot initiative to label GE foods, on November 5.

If Monsanto can’t stop states from passing laws, then the next step is a national preemptive measure. And all signs point to just such a power grab. Earlier this year, Monsanto slipped its extremely unpopular “Monsanto Protection Act,” an act that gives biotech immunity from federal prosecution for planting illegally approved GE crops, into the 2013 Federal Appropriations Bill. During the June 2012 Farm Bill debate, 73 U.S. Senators voted against the right of states to pass mandatory GE food labeling laws. Emboldened by these votes, and now the House Ag Committee’s vote on the King Amendment, Monsanto has every reason to believe Congress would support a potential nullification of states’ rights to label.

The million-strong OCA and its allies in the organic and natural health movement are warning incumbent Senators and House members, Democrats and Republicans alike, that thousands of health and environmental-minded constituents in their Congressional districts or states will work to recall them or drive them out of office if they fail to heed the will of the people and to respect the time-honored traditions of shared state sovereignty over food labels, food safety laws, and consumers’ right to know.

Trouble in Monsanto Nation.

Over the past 20 years Monsanto and the biotech industry, aided and abetted by indentured politicians and corporate agribusiness, have begun seizing control over the global food and farming system, including the legislative, patent, trade, judicial and regulatory bodies that are supposed to safeguard the public interest.

In the U.S., despite mounting evidence of the damage GE crops inflict on human health and the environment, approximately 170 million acres of GE crops, including corn, soybeans, cotton, canola, sugar beets, alfalfa, papaya, and squash, are currently under cultivation. These crops, untested and unlabeled, comprise 41 percent of all cultivated cropland, or 17 percent of all cropland and pastureland combined. According to the GMA, at least 70 percent of non-organic grocery store processed foods contain GMOs. And GE grains and mill byproducts now supply the overwhelming majority of animal feed on the factory farms that supply 90 percent to 95 percent of the meat, eggs and dairy products that Americans consume.

Yet despite their marketplace dominance, record profits and enormous political clout in Washington D.C., Monsanto and the biotech industry are in deep trouble. Evidence is mounting that Monsanto’s top-selling herbicide, Roundup, is a deadly poison, destroying important human gut bacteria and likely contributing to the rapid increase of food allergies and serious human diseases including cancer, autism, neurological disorders , Attention Deficit Hyperactive Disorder (ADHD), dementia, Alzheimer’s, schizophrenia and bipolar disorder. Those most susceptible to poisoning by Monsanto’s Roundup are children and the elderly.

Scientists aren’t the only ones raising new questions about Roundup. Farmers are complaining that they’re being forced to spray more and more chemicals on crops increasingly under siege from a growing army of herbicide-resistant weeds. The situation is so bad that the U.S. Environmental Protection Agency (EPA) just raised the limits of Roundup residue allowed on grains and vegetables to even more dangerous levels. But just in case the EPA someday stops raising the limits, Monsanto, Dow and the biotech industry are working on a new “solution” to the onslaught of herbicide-resistant Superweeds: They’ve applied for approval of a new and highly controversial generation of super toxic herbicide-resistant GE crops, including “Agent Orange” (2,4-D and dicamba-resistant) corn, soybeans and cotton.

As a recent widely-circulated article points out,

“The use of 2,4-D is not new; it’s actually one of the most widely used herbicides in the world. What is new is that farmers will now ‘carpet bomb’ staple food crops like soy and corn with this chemical at a previously unprecedented scale—just the way glyphosate has been indiscriminately applied as a result of Roundup Ready crops. In fact, if 2,4-D resistant crops receive approval and eventually come to replace Monsanto's failing Roundup-resistant crops as Dow intends, it is likely that billions of pounds will be needed, on top of the already insane levels of Roundup being used (1.6 billion lbs were used in 2007 in the US alone).”

In addition to these Agent Orange crops, an expanded menu of genetically engineered organisms are awaiting approval. Next on the menu? GE apples, trees, and salmon.

State Labeling Laws: The ‘skull and crossbones’ that terrify Monsanto

Monsanto’s greatest fear isn’t a federal government charged with protecting the health and safety of its citizens. Congress and the White House seem only too happy to oblige the biotech industry’s unquenchable thirst for growth, power and dominance. No, it’s the massive, unstoppable (so far) grassroots movement of Millions Against Monsanto that strikes fear in the heart of the Biotech Bully. U.S. citizens are waking up. They’re demanding labels on genetically engineered foods, similar to those already required in the European Union. They’re calling for serious independent safety-testing of GE crops and animals, both those already approved (especially Monsanto’s Roundup-resistant crops) and those awaiting approval.

The anti-GMO movement has finally figured out, after 20 years of fruitlessly lobbying Congress, the FDA and the White House, that the federal government is not going to require labels on GE foods. Instead the movement has shifted the battleground on GMO labeling from Monsanto and Big Food’s turf in Washington D.C. to the more favorable terrain of state ballot initiatives and state legislative action—publicizing the fact that a state GMO labeling law will have the same marketplace impact as a national labeling law.

State laws spell doom for Monsanto. Companies like Kellogg’s, General Mills, Coca-Cola, Pepsi/Frito-Lay, Dean Foods, Unilever, Con-Agra, Safeway, Wal-Mart and Smuckers are not going to label in just one or two states. Monsanto knows that U.S. food companies will go GMO-free in the entire U.S., rather than admit to consumers that their products contain GMOs.

As Monsanto itself has pointed out, labels on genetically engineered foods are like putting a “skull and crossbones” on food packages. This is why Monsanto and their allies poured $46 million into defeating a California ballot initiative last year that would have required labels on GMO foods. This is why Monsanto has lobbied strenuously in 30 states this year to prevent, or at least delay, state mandatory labeling laws from being passed. This is why Monsanto has threatened to file federal lawsuits against Vermont, Connecticut, Maine and Washington if they dare grant citizens the right to know whether or not their food has been genetically engineered or not.

And this is why Monsanto’s minions are trying to insert amendments or riders into the Farm Bill that will make it nearly impossible, even illegal, for states to pass GMO labeling laws. And there’s nothing to stop them when Congress is filled with pro-biotech cheerleaders who could care less that 90 percent of U.S. consumers want mandatory labels and proper safety testing of genetically engineered crops and foods.

Countering Monsanto’s Final Offensive: Throw the Bums Out!

Only a massive grassroots resistance will deter the U.S. Senate and House from stomping on our rights. Only an unprecedented campaign of public education, petition-gathering and grassroots pressure will be able to convince the ever-more corrupt and indentured politicians in Washington D.C. to back off.

Eighteen state constitutions have century-old provisions for state registered voters to collect petitions and recall state and local officials, forcing them to either resign or stand for reelection. But what very few Americans, and even members of Congress, realize is that 11 states have constitutional provisions to recall U.S. Senators and House of Representative members, as well as state elected officials.

It’s time we exercise the full power of direct democracy, not just state and municipal ballot initiatives. We must continue to support efforts like the current state ballot initiative to label GMOs in Washington state, and county ballot initiatives to ban GMOs, factory farms and other corporate crimes, in the 24 states and hundreds of counties and municipalities where these are allowed. But we also need to use the power we have to recall and throw out of office our out-of-control Congressional Senators and Representatives as well.

If our elected officials in Congress continue to represent Monsanto and big corporations, rather than their constituents, then let’s throw the bums out! If the Washington political Establishment, both Democrats and Republicans, continue to trample on our inalienable constitutional rights and contemptuously disregard the 225-year principle of a shared balance of power between the federal government, the states and local government, then we have no choice but to recall them or throw them out of office.

Please join the nation’s organic consumers and natural health advocates in this strategic battle, the Food Fight of Our Lives. Please join this campaign to save, not only our right to choose what’s in our food, but our basic right to democratic representation and self-determination as well. Sign the petition. Tell your Congressmen and women, especially the 73 incumbents who voted last year to eliminate states rights’ to legislate on GMO labels, and those in the House this week who voted to support the King Amendment that “enough is enough,” “ basta ya.” Power to the People!

Genetically Modified Democracy: Monsanto and Congress Move to Stomp on States' Rights

In response to this blatant violation of states’ rights to legislate, and consumers’ right to know, the OCA and a nationwide alliance have launched a petition to put every member of Congress on notice: If you support any Farm Bill amendment that would nullify states’ rights to label genetically modified organisms (GMOs), we’ll vote – or throw – you out of office.

On Wednesday, May 15, an amendment to the House version of the Farm Bill, inserted under the guise of protecting interstate commerce, passed out of the House Agricultural Committee. If the King Amendment makes it into the final Farm Bill, it would take away states’ rights to pass laws governing the production or manufacture of any agricultural product, including food and animals raised for food, that is involved in interstate commerce. The amendment was proposed by Rep. Steve King (R-Iowa), largely in response to a California law stating that by 2015, California will allow only eggs to be sold from hens housed in cages specified by California. But policy analysts emphasize that the amendment, broadly and ambiguously written, could be used to prohibit or preempt any state GMO labeling or food safety law.

Will the King Amendment survive the Senate? No one can be sure, say analysts. However few doubt that Monsanto will give up. We can expect that more amendments and riders will be introduced into the Farm Bill--even if the King Amendment fails—over the next month in an attempt to stop the wave of state GMO labeling laws and initiatives moving forward in states like Washington, Vermont, Maine, Connecticut and others.

Monsanto and the Grocery Manufacturers Association (GMA) have admitted privately that they’ve “lost the battle” to stop GE food labeling at the state level, now that states are aggressively moving forward on labeling laws. On May 14, Maine’s House Ag Committee passed a GMO labeling law. On May 10, the Vermont House passed a labeling bill, 99-42, despite massive lobbying by Monsanto and threats to sue the state. And though Monsanto won a razor-thin victory (51 percent to 49 percent) in a costly, hard fought California GMO labeling ballot initiative last November, biotech and Big Food now realize that Washington State voters will likely pass I-522, an upcoming ballot initiative to label GE foods, on November 5.

If Monsanto can’t stop states from passing laws, then the next step is a national preemptive measure. And all signs point to just such a power grab. Earlier this year, Monsanto slipped its extremely unpopular “Monsanto Protection Act,” an act that gives biotech immunity from federal prosecution for planting illegally approved GE crops, into the 2013 Federal Appropriations Bill. During the June 2012 Farm Bill debate, 73 U.S. Senators voted against the right of states to pass mandatory GE food labeling laws. Emboldened by these votes, and now the House Ag Committee’s vote on the King Amendment, Monsanto has every reason to believe Congress would support a potential nullification of states’ rights to label.

The million-strong OCA and its allies in the organic and natural health movement are warning incumbent Senators and House members, Democrats and Republicans alike, that thousands of health and environmental-minded constituents in their Congressional districts or states will work to recall them or drive them out of office if they fail to heed the will of the people and to respect the time-honored traditions of shared state sovereignty over food labels, food safety laws, and consumers’ right to know.

Trouble in Monsanto Nation.

Over the past 20 years Monsanto and the biotech industry, aided and abetted by indentured politicians and corporate agribusiness, have begun seizing control over the global food and farming system, including the legislative, patent, trade, judicial and regulatory bodies that are supposed to safeguard the public interest.

In the U.S., despite mounting evidence of the damage GE crops inflict on human health and the environment, approximately 170 million acres of GE crops, including corn, soybeans, cotton, canola, sugar beets, alfalfa, papaya, and squash, are currently under cultivation. These crops, untested and unlabeled, comprise 41 percent of all cultivated cropland, or 17 percent of all cropland and pastureland combined. According to the GMA, at least 70 percent of non-organic grocery store processed foods contain GMOs. And GE grains and mill byproducts now supply the overwhelming majority of animal feed on the factory farms that supply 90 percent to 95 percent of the meat, eggs and dairy products that Americans consume.

Yet despite their marketplace dominance, record profits and enormous political clout in Washington D.C., Monsanto and the biotech industry are in deep trouble. Evidence is mounting that Monsanto’s top-selling herbicide, Roundup, is a deadly poison, destroying important human gut bacteria and likely contributing to the rapid increase of food allergies and serious human diseases including cancer, autism, neurological disorders , Attention Deficit Hyperactive Disorder (ADHD), dementia, Alzheimer’s, schizophrenia and bipolar disorder. Those most susceptible to poisoning by Monsanto’s Roundup are children and the elderly.

Scientists aren’t the only ones raising new questions about Roundup. Farmers are complaining that they’re being forced to spray more and more chemicals on crops increasingly under siege from a growing army of herbicide-resistant weeds. The situation is so bad that the U.S. Environmental Protection Agency (EPA) just raised the limits of Roundup residue allowed on grains and vegetables to even more dangerous levels. But just in case the EPA someday stops raising the limits, Monsanto, Dow and the biotech industry are working on a new “solution” to the onslaught of herbicide-resistant Superweeds: They’ve applied for approval of a new and highly controversial generation of super toxic herbicide-resistant GE crops, including “Agent Orange” (2,4-D and dicamba-resistant) corn, soybeans and cotton.

As a recent widely-circulated article points out,

“The use of 2,4-D is not new; it’s actually one of the most widely used herbicides in the world. What is new is that farmers will now ‘carpet bomb’ staple food crops like soy and corn with this chemical at a previously unprecedented scale—just the way glyphosate has been indiscriminately applied as a result of Roundup Ready crops. In fact, if 2,4-D resistant crops receive approval and eventually come to replace Monsanto's failing Roundup-resistant crops as Dow intends, it is likely that billions of pounds will be needed, on top of the already insane levels of Roundup being used (1.6 billion lbs were used in 2007 in the US alone).”

In addition to these Agent Orange crops, an expanded menu of genetically engineered organisms are awaiting approval. Next on the menu? GE apples, trees, and salmon.

State Labeling Laws: The ‘skull and crossbones’ that terrify Monsanto

Monsanto’s greatest fear isn’t a federal government charged with protecting the health and safety of its citizens. Congress and the White House seem only too happy to oblige the biotech industry’s unquenchable thirst for growth, power and dominance. No, it’s the massive, unstoppable (so far) grassroots movement of Millions Against Monsanto that strikes fear in the heart of the Biotech Bully. U.S. citizens are waking up. They’re demanding labels on genetically engineered foods, similar to those already required in the European Union. They’re calling for serious independent safety-testing of GE crops and animals, both those already approved (especially Monsanto’s Roundup-resistant crops) and those awaiting approval.

The anti-GMO movement has finally figured out, after 20 years of fruitlessly lobbying Congress, the FDA and the White House, that the federal government is not going to require labels on GE foods. Instead the movement has shifted the battleground on GMO labeling from Monsanto and Big Food’s turf in Washington D.C. to the more favorable terrain of state ballot initiatives and state legislative action—publicizing the fact that a state GMO labeling law will have the same marketplace impact as a national labeling law.

State laws spell doom for Monsanto. Companies like Kellogg’s, General Mills, Coca-Cola, Pepsi/Frito-Lay, Dean Foods, Unilever, Con-Agra, Safeway, Wal-Mart and Smuckers are not going to label in just one or two states. Monsanto knows that U.S. food companies will go GMO-free in the entire U.S., rather than admit to consumers that their products contain GMOs.

As Monsanto itself has pointed out, labels on genetically engineered foods are like putting a “skull and crossbones” on food packages. This is why Monsanto and their allies poured $46 million into defeating a California ballot initiative last year that would have required labels on GMO foods. This is why Monsanto has lobbied strenuously in 30 states this year to prevent, or at least delay, state mandatory labeling laws from being passed. This is why Monsanto has threatened to file federal lawsuits against Vermont, Connecticut, Maine and Washington if they dare grant citizens the right to know whether or not their food has been genetically engineered or not.

And this is why Monsanto’s minions are trying to insert amendments or riders into the Farm Bill that will make it nearly impossible, even illegal, for states to pass GMO labeling laws. And there’s nothing to stop them when Congress is filled with pro-biotech cheerleaders who could care less that 90 percent of U.S. consumers want mandatory labels and proper safety testing of genetically engineered crops and foods.

Countering Monsanto’s Final Offensive: Throw the Bums Out!

Only a massive grassroots resistance will deter the U.S. Senate and House from stomping on our rights. Only an unprecedented campaign of public education, petition-gathering and grassroots pressure will be able to convince the ever-more corrupt and indentured politicians in Washington D.C. to back off.

Eighteen state constitutions have century-old provisions for state registered voters to collect petitions and recall state and local officials, forcing them to either resign or stand for reelection. But what very few Americans, and even members of Congress, realize is that 11 states have constitutional provisions to recall U.S. Senators and House of Representative members, as well as state elected officials.

It’s time we exercise the full power of direct democracy, not just state and municipal ballot initiatives. We must continue to support efforts like the current state ballot initiative to label GMOs in Washington state, and county ballot initiatives to ban GMOs, factory farms and other corporate crimes, in the 24 states and hundreds of counties and municipalities where these are allowed. But we also need to use the power we have to recall and throw out of office our out-of-control Congressional Senators and Representatives as well.

If our elected officials in Congress continue to represent Monsanto and big corporations, rather than their constituents, then let’s throw the bums out! If the Washington political Establishment, both Democrats and Republicans, continue to trample on our inalienable constitutional rights and contemptuously disregard the 225-year principle of a shared balance of power between the federal government, the states and local government, then we have no choice but to recall them or throw them out of office.

Please join the nation’s organic consumers and natural health advocates in this strategic battle, the Food Fight of Our Lives. Please join this campaign to save, not only our right to choose what’s in our food, but our basic right to democratic representation and self-determination as well. Sign the petition. Tell your Congressmen and women, especially the 73 incumbents who voted last year to eliminate states rights’ to legislate on GMO labels, and those in the House this week who voted to support the King Amendment that “enough is enough,” “ basta ya.” Power to the People!

Genetically Modified Democracy: Monsanto and Congress Move to Stomp on States' Rights

Soil Restoration - Water shed death spiral due to compaction, roads, and loss of soil organic matter - Mark Vander Meer

Published on Apr 30, 2013

http://permies.com

http://watershedconsulting.com

Mark Vander Meer gives a presentation on soil science as it relates to forestry. I was presenting in another room at the same time, so Mark gave permission to Jocelyn Campbell to record this for me. Once I saw it, I thought it was so good, that I asked Mark if it was okay to put it up on youtube ...

Mark is a soil scientist who works as a wild restoration ecologist in Montana. His presentation focuses on soil restoration and is very much question driven.

He starts off by talking about the water shed death spiral where the soil looses its ability to hold water. Mark identifies three main reasons for that to occur: Compaction, roads, and loss of soil organic matter. He explains that the problem results in streams and springs disappearing.

He then starts talking about soil basic components (sand, silt, and clay) and the very important water stable aggregate. This last component is formed of sand, silt and clay held together mostly by fungi. The water stable aggregate is very important because it holds its form in the presence of water and allows the soil to keep pockets of air instead of turning to pudding. These air pockets are critical to biological life.

Mark explains that gardeners are very accustomed to creating water stable aggregate by adding compost to soil. In his work he uses slashing (the wood bits and branches left over from logging) to restore the aggregate after logging operations. He then explains that spreading slashing helps to decompact the soil and to restore biological activity. In turns this helps to restore the water shed health.

He concludes the presentation talking about road reclamation, deer pressure, and white rot vs. brown rot.

http://tinyurl.com/cods8cu

Occam's Grazer: An In-depth Introduction to Holistic Management - YouTube

Occam's Grazer provides an introduction to Holistic Management and holistic grazing as well as many powerful insights, philosophies, and useful ideas from people who are using the framework and practices every day. This video is a must for anyone who wants to learn more about taking a holistic approach to grazing in their ranch business, how it works, and the potential benefits. It was designed to be a resource for ranchers, potential ranchers, environmentalists, and educators, but is also being well received by the general public.

Occam's Grazer: An In-depth Introduction to Holistic Management - YouTube

Reversing global warming with livestock?: Seth Itzkan at TEDxSomerville - YouTube

Global warming may be mitigated by the most unlikely of sources, cattle. How is this possible? How can this vilified creature be an ally in the fight against climate change? Seth Itzkan shows us how.

Seth is President of Planet-TECH Associates, a consultancy that investigates innovations for a regenerative future. He has consulted on trends and innovations for The Boston Foundation, The Massachusetts Technology Collaborative, and The US Census Bureau. Seth is a graduate of Tufts University College of Engineering and the University of Houston-Clear Lake Masters Program in Studies of Future. He works in Somerville, and recently spent six weeks at the Africa Center for Holistic Management in Zimbabwe.

Allan Savory - Reversing Global Warming while Meeting Human Needs (videos)

Amazing Man! - Allan Savory

Using livestock to green dry areas and desserts. A new way to farm in a regenrative way, even in wetter climates... Monte Hines

Full Post and Videos: Allan Savory - Reversing Global Warming while Meeting Human Needs (videos)

May 16, 2013

Food supply under assault as climate heats up

AP file

Corn from last year's harvest lies in a wet field on a farm near Carlisle, Iowa last Tuesday. The USDA's weekly crop progress report showed that just 12 percent of the nation's cornfields have been sown.

Bill Briggs NBC News contributor

American eaters, let’s talk about the birds and the bees: The U.S. food supply – from chickens injected with arsenic to dying bee colonies – is under unprecedented siege from a blitz of man-made hazards, meaning some of your favorite treats someday may vanish from your plate, experts say.

Warmer and moister air ringing much of the planet – punctuated by droughts in other locales – is threatening the prime ingredients in many daily meals, including the maple syrup on your morning pancakes and the salmon on your evening grill as well as the wine in your glass andthe chocolate on your dessert tray, according to four recent studies.

At the same time, an unappetizing bacterial outbreak in Florida citrus droves, largely affecting orange trees, is causing fruit to turn bitter. Elsewhere, unappealing fungi strains are curtailing certain coffee yields and devastating some banana plantations, researchers report.

Now, mix in the atmospheric misfortunes sapping two mainstays of American farming — corn and cows. Heavier than normal spring rains have put the corn crop far behind schedule: Only 28 percent of corn fields have been planted this year compared with 85 percent at this time in 2012, according to the U.S. Department of Agriculture. Meanwhile, drought in the Southeastern plains and a poor hay yield have culled the U.S. cattle and calf herd to its lowest level since 1952, propelling the wholesale price of a USDA cut of choice beef to a new high on May 3 — $201.68 per 100 pounds, eclipsing the old mark of $201.18 from October 2003, the USDA reports.

“We are in the midst of dramatic assault on the security of the food supply,” said Dr. Robert S. Lawrence, director of the Center for a Livable Future, part of the Johns Hopkins Bloomberg School of Public Health. The group promotes ecological research into the nexus of diet, food production, environment and human health.

The primary culprit of all this menu mayhem is climate change, which is choking off certain crops already weakened by both genetic tinkering and chemically based farming, some experts contend.

Agricultural history is, of course, laced with tales of crop-munching bug swarms and dirt-baking droughts, leading to famous regional famines. Paleontologists have even argued that the hanging gardens of ancient Babylon dried up because people messed with that micro-climate by slashing too many trees, over-expanding farm fields and exhausting the water supply, Lawrence said.

“So there are precedents but they’ve all been local and people just abandoned those areas and moved on,” he added. “What’s very sobering about the situation today: This is global and there isn’t any other place to go on this spaceship Earth. We need to regard all of these (examples) as a very powerful motivator to try to work on the carbon emissions, to start pushing that parts per million of carbon dioxide back down.”

Robin Loznak

The world’s collective appetite also is growing as populations rise, leading large, commercial growers and exporters to ship more food internationally – and allowing certain plant-consuming bacteria, fungi and viruses to “hitchhike half way around the world in a day,” public health researcher says.

Last week, the ratio of carbon dioxide in the atmosphere soared to the highest daily average ever recorded by an air monitor station at Mauna Loa in Hawaii — nearly 400 parts per million (ppm), said John Ewald, a spokesman for the National Oceanic and Atmospheric Association, who called it "an extremely important milestone." When that gauge was installed in 1958, the observatory measured a CO2 concentration of 313 ppm. The number means there were 313 molecules of carbon dioxide in the air for every 1 million molecules of air.

“That warmer and more moist air (caused by the CO2) creates the conditions that certain pathogens thrive on,” Lawrence said. “That’s the dilemma with things like the coffee fungi and some of the problems with citrus.”

The world’s collective appetite also is growing as populations rise, leading large, commercial growers and exporters to ship more food internationally – and allowing certain plant-consuming bacteria, fungi and viruses to “hitchhike half way around the world in a day,” Lawrence added.

Moreover, to help meet the need to feed those extra mouths, industrial agriculture has increasingly turned to “mono-culture” farming to boost harvests. That means using science to alter plants and sewing huge fields – fencepost to fencepost – with single crops.

“For instance, corn plants in the American Midwest are grown closer together and taller than they have been in the past because we’re genetically engineering them to do that,” said Lee Hannah, senior fellow at Conservation International, a global nonprofit that advocates for sustainable policies. “That produces a lot more food. But it also makes that corn more vulnerable to disease, which, if it gets into that mono-culture system, can sweep through it much as a disease will go through a city a lot faster than it does a rural countryside.

“We’re in a situation where the food supply is more vulnerable than it has ever been,” added Hannah, also an adjunct faculty member at the Bren School of Environmental Science & Management at the University of California at Santa Barbara.

Hannah authored a recent study that predicted climate change may shrink California’s wine-growing areas by as much as 70 percent by 2050.

But less wine in our homes could – some conservationists hope – grab the attention of American consumers who can’t otherwise get their heads around shrinking polar ice caps.

“Maybe seeing this impact all this has on our ability to raise the food we depend on will get us to the tipping point of real policy change and real action,” Lawrence said. “I hope so.”

Full Article: Food supply under assault as climate heats up - NBC News.com

The world’s collective appetite also is growing as populations rise, leading large, commercial growers and exporters to ship more food internationally – and allowing certain plant-consuming bacteria, fungi and viruses to “hitchhike half way around the world in a day,” public health researcher says.

Last week, the ratio of carbon dioxide in the atmosphere soared to the highest daily average ever recorded by an air monitor station at Mauna Loa in Hawaii — nearly 400 parts per million (ppm), said John Ewald, a spokesman for the National Oceanic and Atmospheric Association, who called it "an extremely important milestone." When that gauge was installed in 1958, the observatory measured a CO2 concentration of 313 ppm. The number means there were 313 molecules of carbon dioxide in the air for every 1 million molecules of air.

“That warmer and more moist air (caused by the CO2) creates the conditions that certain pathogens thrive on,” Lawrence said. “That’s the dilemma with things like the coffee fungi and some of the problems with citrus.”

The world’s collective appetite also is growing as populations rise, leading large, commercial growers and exporters to ship more food internationally – and allowing certain plant-consuming bacteria, fungi and viruses to “hitchhike half way around the world in a day,” Lawrence added.

Moreover, to help meet the need to feed those extra mouths, industrial agriculture has increasingly turned to “mono-culture” farming to boost harvests. That means using science to alter plants and sewing huge fields – fencepost to fencepost – with single crops.

“For instance, corn plants in the American Midwest are grown closer together and taller than they have been in the past because we’re genetically engineering them to do that,” said Lee Hannah, senior fellow at Conservation International, a global nonprofit that advocates for sustainable policies. “That produces a lot more food. But it also makes that corn more vulnerable to disease, which, if it gets into that mono-culture system, can sweep through it much as a disease will go through a city a lot faster than it does a rural countryside.

“We’re in a situation where the food supply is more vulnerable than it has ever been,” added Hannah, also an adjunct faculty member at the Bren School of Environmental Science & Management at the University of California at Santa Barbara.

Hannah authored a recent study that predicted climate change may shrink California’s wine-growing areas by as much as 70 percent by 2050.

But less wine in our homes could – some conservationists hope – grab the attention of American consumers who can’t otherwise get their heads around shrinking polar ice caps.

“Maybe seeing this impact all this has on our ability to raise the food we depend on will get us to the tipping point of real policy change and real action,” Lawrence said. “I hope so.”

Full Article: Food supply under assault as climate heats up - NBC News.com

Find out about permaculture! Use it to fit your situation!!!

Larger Image

http://tcpermaculture.com/site/

Permaculture

- New to Permaculture? Find out what it is all about! Learn More

- BlogArticles almost every day on a variety of Permaculture topics! Learn More

- Plant IndexA listing of plants that are perfect for both small and large Permaculture designs in a Temperate Climate! Learn More

Find out about permaculture!

Use it to fit your situation!!!

Monte Hines

INSPIRING FUTURE - We are at the beginning of a new energy revolution! - This Is Lateral Power - YouTube

We can have a positive future, but we all must fight for it in our own way... Monte Hines

Published on Apr 13, 2012

What happens when an Internet revolution merges with a renewable energy revolution? Jeremy Rifkin, author of 19 books on the impact of scientific and technological changes on the economy, the workforce, society, and the environment and adviser to President Nicolas Sarkozy of France, Chancellor Angela Merkel of Germany, speaks about a new Third Industrial Revolution - one based on a distributed, lateral power. The result may just be a sustainable world.

This Is Lateral Power - YouTube

New phone app allows users to boycott Koch Brothers and Monsanto products | The Raw Story

YES!!! Monte Hines

By Arturo Garcia

Wednesday, May 15, 2013

A phone app allowing users to identify products used by questionable companies like Koch Industries and Monsanto has generated enough demand to cause problems for the developer, Forbes reported on Tuesday.

“The workload is a bit overwhelming now,” said 26-year-old Ivan Pardo, the developer behindBuycott. “Our Android app was just recently released and the surge of new users today has highlighted a serious bug on certain devices that needs to be fixed immediately. So all other development tasks I was working on get put on hold until I can get this bug fixed.”

Pardo, who has been designing the app over the past 16 months, said there is no partisanship behind Buycott, which provides users with the ownership background of products by scanning their barcode.

The app also allows users to take part in online campaigns that boycott or, alternatively, highlight companies that support their political viewpoints. Buycott is also asking users to help keep its database updated by sharing products not yet recognized by the app.

“It was critical to allow users to create campaigns,” Pardo said. “I don’t think its Buycott’s role to tell people what to buy. We simply want to provide a platform that empowers consumers to make well-informed purchasing decisions.”

The idea of an app giving consumers a chance to better align their shopping habits with their ethics gained attention when it was proposed during the Netroots Nation conference in June 2012 by Darcy Bruner, a Democratic congressional candidate in Washington state and former programmer for Microsoft.

“The Kochs have a record of spending enormous amounts of money to move very reactionary, right-wing policies,” she said at the time. “Most Americans disagree with those policies but they may be buying products that are bankrolling them.”

Bruner created a mock interface for her proposal, but was not able to proceed any further. But Pardo was already independently working on his own version.

["Angry woman making a phone call" via Shutterstock]

=======

Koch-blocked! App Helps You Boycott Koch Brothers and Monsanto

Published on May 15, 2013

"A phone app allowing users to identify products used by questionable companies like Koch Industries and Monsanto has generated enough demand to cause problems for the developer, Forbes reported on Tuesday."*

The Buycott phone app helps users boycott companies and groups like the Koch Brothers and Monsanto, as well as other corporations that actively work against the user's ideology. But...will we like what the app tells us? Ana Kasparian and Dave Rubin (Rubin Report) discuss.

Links:

New phone app allows users to boycott Koch Brothers and Monsanto products | The Raw Story

http://www.youtube.com/watch?v=uNgzFuOZmOk

http://www.buycott.com/

May 15, 2013

Mysterious Poop Foam Causes Explosions on Hog Farms | Mother Jones

—By Tom Philpott

| Wed May. 15, 2013 3:00 AM PDT

| Wed May. 15, 2013 3:00 AM PDT

A sample of the manure foam that caused an explosion that lifted a hog barn two feet off the ground and blew a man 20 feet away from where he had been standing (see video below).Screenshot from the video embedded below.

When you hear about foam in the context of food, you might think of molecular gastronomy, the culinary innovations of the Spanish chef Ferran Adrià, who's famous for dishes like apple caviar with banana foam.

But this post is about a much less appetizing kind of foam. You see, starting in about 2009, in the pits that capture manure under factory-scale hog farms, a gray, bubbly substance began appearing at the surface of the fecal soup. The problem is menacing: As manure breaks down, it emits toxic gases like hydrogen sulfide and flammable ones like methane, and trapping these noxious fumes under a layer of foam can lead to sudden, disastrous releases and even explosions. According to a 2012 report from the University of Minnesota, by September 2011, the foam had "caused about a half-dozen explosions in the upper Midwest…one explosion destroyed a barn on a farm in northern Iowa, killing 1,500 pigs and severely burning the worker involved."

Rest of Story and Video: Mysterious Poop Foam Causes Explosions on Hog Farms | Mother Jones

When you hear about foam in the context of food, you might think of molecular gastronomy, the culinary innovations of the Spanish chef Ferran Adrià, who's famous for dishes like apple caviar with banana foam.

But this post is about a much less appetizing kind of foam. You see, starting in about 2009, in the pits that capture manure under factory-scale hog farms, a gray, bubbly substance began appearing at the surface of the fecal soup. The problem is menacing: As manure breaks down, it emits toxic gases like hydrogen sulfide and flammable ones like methane, and trapping these noxious fumes under a layer of foam can lead to sudden, disastrous releases and even explosions. According to a 2012 report from the University of Minnesota, by September 2011, the foam had "caused about a half-dozen explosions in the upper Midwest…one explosion destroyed a barn on a farm in northern Iowa, killing 1,500 pigs and severely burning the worker involved."

Rest of Story and Video: Mysterious Poop Foam Causes Explosions on Hog Farms | Mother Jones

May 14, 2013

U.S. Taxpayers Footing Bill That Promotes Monsanto Abroad: Report

Reuters | Posted: 05/14/2013

* Report critical of State Dept for promoting biotech crops

* Monsanto interests mentioned in cables

By Carey Gillam

May 14 (Reuters) - U.S. taxpayers are footing the bill for overseas lobbying that promotes controversial biotech crops developed by U.S.-based Monsanto Co and other seed makers, a report issued on Tuesday said.

A review of 926 diplomatic cables of correspondence to and from the U.S. State Department and embassies in more than 100 countries found that State Department officials actively promoted the commercialization of specific biotech seeds, according to the report issued by Food & Water Watch, a nonprofit consumer protection group.

The officials tried to quash public criticism of particular companies and facilitated negotiations between foreign governments and seed companies such as Monsanto over issues like patents and intellectual property, the report said.

The cables show U.S. diplomats supporting Monsanto, the world's largest seed company, in foreign countries even after it paid $1.5 million in fines after being charged with bribing an Indonesian official and violating the Foreign Corrupt Practices Act in 2005.

One 2009 cable shows the embassy in Spain seeking "high-level U.S. government intervention" at the "urgent request" of Monsanto to combat biotech crop opponents there, according to the Food & Water Watch report.

The report covered cables from 2005-2009 that were released by Wikileaks in 2010 as part of a much larger release by Wikileaks of a range of diplomatic cables it obtained.

Monsanto spokesman Tom Helscher said Monsanto believes it is critical to maintain an open dialogue with government authorities and trade groups in other countries.

"We remain committed to sharing information so that individuals can better understand our business and our commitments to support farmers throughout the world as they work to meet the agriculture demands of our world's growing population," he said.

State Department officials had no immediate comment when contacted about the report.

Food & Water Watch said the cables it examined provide a detailed account of how far the State Department goes to support and promote the interests of the agricultural biotech industry, which has had a hard time gaining acceptance in many foreign markets.

"It really goes beyond promoting the U.S.'s biotech industry and agriculture," said Wenonah Hauter, executive director of Food & Water Watch. "It really gets down to twisting the arms of countries and working to undermine local democratic movements that may be opposed to biotech crops, and pressuring foreign governments to also reduce the oversight of biotech crops."

But U.S. officials, Monsanto and many other companies and industry experts routinely say that biotech crops are needed around the world to increase global food production as population expands. They maintain that the crops are safe and make farming easier and more environmentally sustainable.

PROMOTION THROUGH PAMPHLETS, DVDs?

The cables show that State Department officials directed embassies to "troubleshoot problematic legislation" that might hinder biotech crop development and to "encourage the development and commercialization of ag-biotech products".

The State Department also produced pamphlets in Slovenia promoting biotech crops, sent pro-biotech DVDs to high schools in Hong Kong and helped bring foreign officials and media from 17 countries to the United States to promote biotech agriculture, Food & Water Watch said.

Genetically altered crops are widely used in the United States. Crops spliced with DNA from other species are designed to resist pests and tolerate chemical applications, and since their introduction in the mid 1990s have come to dominate millions of acres of U.S. farmland.

The biotech crops are controversial with some groups and in many countries because some studies have shown harmful health impacts for humans and animals, and the crops have been associated with some environmental problems.

They also generally are more expensive than conventional crops, and the biotech seed developers patent the high-tech seeds so farmers using them have to buy new seed every season, a factor that makes them unappealing in some developing nations.

Many countries ban planting of biotech crops or have strict labeling requirements.

"It's appalling that the State Department is complicit in supporting their (the biotech seed industry's) goals despite public and government opposition in several countries," said Ronnie Cummins, executive director of nonprofit organization Organic Consumers Association.

"American taxpayer's money should not be spent advancing the goals of a few giant biotech companies."

* Report critical of State Dept for promoting biotech crops

* Monsanto interests mentioned in cables

By Carey Gillam

May 14 (Reuters) - U.S. taxpayers are footing the bill for overseas lobbying that promotes controversial biotech crops developed by U.S.-based Monsanto Co and other seed makers, a report issued on Tuesday said.

A review of 926 diplomatic cables of correspondence to and from the U.S. State Department and embassies in more than 100 countries found that State Department officials actively promoted the commercialization of specific biotech seeds, according to the report issued by Food & Water Watch, a nonprofit consumer protection group.

The officials tried to quash public criticism of particular companies and facilitated negotiations between foreign governments and seed companies such as Monsanto over issues like patents and intellectual property, the report said.

The cables show U.S. diplomats supporting Monsanto, the world's largest seed company, in foreign countries even after it paid $1.5 million in fines after being charged with bribing an Indonesian official and violating the Foreign Corrupt Practices Act in 2005.

One 2009 cable shows the embassy in Spain seeking "high-level U.S. government intervention" at the "urgent request" of Monsanto to combat biotech crop opponents there, according to the Food & Water Watch report.

The report covered cables from 2005-2009 that were released by Wikileaks in 2010 as part of a much larger release by Wikileaks of a range of diplomatic cables it obtained.

Monsanto spokesman Tom Helscher said Monsanto believes it is critical to maintain an open dialogue with government authorities and trade groups in other countries.

"We remain committed to sharing information so that individuals can better understand our business and our commitments to support farmers throughout the world as they work to meet the agriculture demands of our world's growing population," he said.

State Department officials had no immediate comment when contacted about the report.

Food & Water Watch said the cables it examined provide a detailed account of how far the State Department goes to support and promote the interests of the agricultural biotech industry, which has had a hard time gaining acceptance in many foreign markets.

"It really goes beyond promoting the U.S.'s biotech industry and agriculture," said Wenonah Hauter, executive director of Food & Water Watch. "It really gets down to twisting the arms of countries and working to undermine local democratic movements that may be opposed to biotech crops, and pressuring foreign governments to also reduce the oversight of biotech crops."

But U.S. officials, Monsanto and many other companies and industry experts routinely say that biotech crops are needed around the world to increase global food production as population expands. They maintain that the crops are safe and make farming easier and more environmentally sustainable.

PROMOTION THROUGH PAMPHLETS, DVDs?

The cables show that State Department officials directed embassies to "troubleshoot problematic legislation" that might hinder biotech crop development and to "encourage the development and commercialization of ag-biotech products".

The State Department also produced pamphlets in Slovenia promoting biotech crops, sent pro-biotech DVDs to high schools in Hong Kong and helped bring foreign officials and media from 17 countries to the United States to promote biotech agriculture, Food & Water Watch said.

Genetically altered crops are widely used in the United States. Crops spliced with DNA from other species are designed to resist pests and tolerate chemical applications, and since their introduction in the mid 1990s have come to dominate millions of acres of U.S. farmland.

The biotech crops are controversial with some groups and in many countries because some studies have shown harmful health impacts for humans and animals, and the crops have been associated with some environmental problems.

They also generally are more expensive than conventional crops, and the biotech seed developers patent the high-tech seeds so farmers using them have to buy new seed every season, a factor that makes them unappealing in some developing nations.

Many countries ban planting of biotech crops or have strict labeling requirements.

"It's appalling that the State Department is complicit in supporting their (the biotech seed industry's) goals despite public and government opposition in several countries," said Ronnie Cummins, executive director of nonprofit organization Organic Consumers Association.

"American taxpayer's money should not be spent advancing the goals of a few giant biotech companies."

THIS IS WRONG!!! HEADS SHOULD ROLL... MONTE HINES

Related links:

Related links:

Chris Hedges: Murder Is Our National Sport

Monday, 13 May 2013

(Image: Jailed hands via Shutterstock)Murder is our national sport.

Full Text of story: Chris Hedges: Murder Is Our National Sport

IPS – Mexico – Ground Zero in the Fight for the Future of Maize | Inter Press Service

By Emilio Godoy

Native varieties of maize, like these drying in San Cristóbal de las Casas, in the southern state of Chiapas, are key to preserving crop diversity. Credit: Mauricio Ramos/IPS

MEXICO CITY, May 8 2013 (IPS) - In the 2011 action-thriller “Unknown”, scientists are persecuted by the biotech industry because they plan the open release of a drought- and pest-resistant strain of maize that could help eradicate world hunger.

There are certain parallels with the situation today in Mexico, the birthplace of maize, which is at the centre of the global fight to protect the crop’s diversity from the onslaught of genetically modified varieties.

“It’s the first time in history that one of the most important harvests in the world is threatened in its centre of diversity,” Pat Mooney, the head of the Action Group on Erosion, Technology and Concentration (ETC Group), an international NGO, told IPS.

“If we let the companies win, there will be no chance to defend them in other parts. What is happening here is of key importance for the rest of the world.”

Civil society organisations are raising their guard against the possibility that the government of conservative President Enrique Peña Nieto of the Institutional Revolutionary Party (PRI) may approve commercial cultivation of transgenic maize, a move widely condemned by environmentalists and other activists, academics, and small and medium producers due to the risks it poses.

In September, the U.S. corporations Monsanto, Pioneer and Dow Agrosciences presented six applications for commercial plantations of transgenic maize on more than two million hectares in the northwestern state of Sinaloa and the northeastern state of Tamaulipas.

Moreover, in January these companies and Syngenta presented 11 applications for pilot and experimental plots to grow transgenic corn on 622 hectares in the northern states of Chihuahua, Coahuila, Durango, Sinaloa and Baja California. And Monsanto has applied for an additional plantation in an unspecified area in the north of the country.

Since 2009, the Mexican government has issued 177 permits for experimental plots of transgenic maize covering an area of 2,664 hectares, according to the latest figures provided by the authorities.

But large-scale commercial release of GM maize has not yet been authorised.

“They are going to serve up transgenic maize on every table in spite of the fact that food sovereignty depends on growing native corn,” said Evangelina Robles, a member of Red en Defensa del Maíz (Maize Defence Network) which campaigns against GM corn. “As a result, we have to demand its prohibition by the state,” she told IPS.

Mexico produces 22 million tonnes of maize a year, and imports 10 million tonnes, according to the agriculture ministry. The country purchased about two million tonnes of GM maize from South Africa over the last two years, and is set to import another 150,000 tonnes.

Three million maize farmers cultivate about eight million hectares in Mexico, two million of which are devoted to family farming. White maize is the main crop for human consumption, while yellow maize, for animal feed, is largely imported.

The National Council for the Evaluation of Social Policy (CONEVAL) estimates the country’s annual consumption of maize at 123 kg per person, compared to a world average of 16.8 kg.

The historical link with pre-Columbian indigenous cultures gives maize a strong symbolic and cultural significance throughout Mesoamerica, the area comprising southern Mexico and Central America, where it was domesticated, producing 59 landraces or native strains and 209 varieties.

In the state of Mexico, adjacent to the capital city’s Federal District, small farmers have found their native maize to be contaminated with GM maize, according to tests carried out by students at the state Autonomous Metropolitan University.

“We swapped seeds and decided to do some tests. Now we are more careful when exchanging, and over who participates in the fair, although we still have to carry out confirmation tests,” activist Sara López, of the Red Origen Volcanes (Volcanoes Origins Network), an association of small farmers that has been organising producers’ fairs since 2010, told IPS.

Environmental, scientific and small farmers’ organisations have discovered GM contamination of native maize in Chihuahua, Hidalgo, Puebla and Oaxaca.

Contamination is “a carefully and perversely planned strategy,” according to Camila Montecinos, from the Chile office of GRAIN, an international NGO that works to support small farmers and social movements in their struggles for community-controlled and biodiversity-based food systems.

Transnational food companies “chose maize, soy and canola because of their enormous potential for contamination (by wind-pollination),” said Montecinos, one of the experts participating in the preliminary hearing on transgenic contamination of native maize at the Permanent Peoples’ Tribunal, an international opinion tribunal which opened its Mexican chapter in 2012 and will conclude with a non-binding ruling in 2014.

“When contamination spreads, the companies claim that the presence of transgenic crops must be recognised and legalised,” in order to pave the way for marketing the GM seeds, to which they own the patents, she said.

Mexico’s environment minister, Juan Guerra, has said that all available scientific information will be examined before a decision is made.

But that will not be easy. The National Confederation of Campesinos (Small Farmers), one of the main internal movements in the ruling PRI, has had an agreement with Monsanto since 2007 under which the company is to “conserve” native varieties.

Meanwhile, the Peña Nieto government still has not approved regulations for the format and contents of reports on the results of releasing GM organisms, and the possible threats to the environment, biodiversity, and the health of animals, plants and fish.

“For 18 years, corporations have been unsuccessful in convincing the people that their products are good. Maize is being used as a means of political and economic control. People need maize to be alive,” the ETC Group’s Mooney said.

The transgenic seeds on the market are herbicide-resistant Roundup Ready and Bt (for the Bacillus thuringiensis gene they carry for pest resistance) versions of cotton, maize, soy and canola. While they are legally grown in Canada, the United States, Argentina, Brazil and Spain, they are banned for example in China, Russia and the majority of the EU countries.

Recent studies published in the United States show that transgenic crops do not significantly increase yield per hectare, do not reduce herbicide use, and do not increase resistance to pests, in contrast to biotech industry claims.

“We are analysing what legal action to take against the new applications (to plant GM maize),” said Robles, of the Maize Defence Network.

IPS – Mexico – Ground Zero in the Fight for the Future of Maize | Inter Press Service

Native varieties of maize, like these drying in San Cristóbal de las Casas, in the southern state of Chiapas, are key to preserving crop diversity. Credit: Mauricio Ramos/IPS

MEXICO CITY, May 8 2013 (IPS) - In the 2011 action-thriller “Unknown”, scientists are persecuted by the biotech industry because they plan the open release of a drought- and pest-resistant strain of maize that could help eradicate world hunger.

There are certain parallels with the situation today in Mexico, the birthplace of maize, which is at the centre of the global fight to protect the crop’s diversity from the onslaught of genetically modified varieties.

“It’s the first time in history that one of the most important harvests in the world is threatened in its centre of diversity,” Pat Mooney, the head of the Action Group on Erosion, Technology and Concentration (ETC Group), an international NGO, told IPS.

“If we let the companies win, there will be no chance to defend them in other parts. What is happening here is of key importance for the rest of the world.”

Civil society organisations are raising their guard against the possibility that the government of conservative President Enrique Peña Nieto of the Institutional Revolutionary Party (PRI) may approve commercial cultivation of transgenic maize, a move widely condemned by environmentalists and other activists, academics, and small and medium producers due to the risks it poses.

In September, the U.S. corporations Monsanto, Pioneer and Dow Agrosciences presented six applications for commercial plantations of transgenic maize on more than two million hectares in the northwestern state of Sinaloa and the northeastern state of Tamaulipas.

Moreover, in January these companies and Syngenta presented 11 applications for pilot and experimental plots to grow transgenic corn on 622 hectares in the northern states of Chihuahua, Coahuila, Durango, Sinaloa and Baja California. And Monsanto has applied for an additional plantation in an unspecified area in the north of the country.

Since 2009, the Mexican government has issued 177 permits for experimental plots of transgenic maize covering an area of 2,664 hectares, according to the latest figures provided by the authorities.

But large-scale commercial release of GM maize has not yet been authorised.

“They are going to serve up transgenic maize on every table in spite of the fact that food sovereignty depends on growing native corn,” said Evangelina Robles, a member of Red en Defensa del Maíz (Maize Defence Network) which campaigns against GM corn. “As a result, we have to demand its prohibition by the state,” she told IPS.

Mexico produces 22 million tonnes of maize a year, and imports 10 million tonnes, according to the agriculture ministry. The country purchased about two million tonnes of GM maize from South Africa over the last two years, and is set to import another 150,000 tonnes.

Three million maize farmers cultivate about eight million hectares in Mexico, two million of which are devoted to family farming. White maize is the main crop for human consumption, while yellow maize, for animal feed, is largely imported.

The National Council for the Evaluation of Social Policy (CONEVAL) estimates the country’s annual consumption of maize at 123 kg per person, compared to a world average of 16.8 kg.

The historical link with pre-Columbian indigenous cultures gives maize a strong symbolic and cultural significance throughout Mesoamerica, the area comprising southern Mexico and Central America, where it was domesticated, producing 59 landraces or native strains and 209 varieties.

In the state of Mexico, adjacent to the capital city’s Federal District, small farmers have found their native maize to be contaminated with GM maize, according to tests carried out by students at the state Autonomous Metropolitan University.

“We swapped seeds and decided to do some tests. Now we are more careful when exchanging, and over who participates in the fair, although we still have to carry out confirmation tests,” activist Sara López, of the Red Origen Volcanes (Volcanoes Origins Network), an association of small farmers that has been organising producers’ fairs since 2010, told IPS.

Environmental, scientific and small farmers’ organisations have discovered GM contamination of native maize in Chihuahua, Hidalgo, Puebla and Oaxaca.

Contamination is “a carefully and perversely planned strategy,” according to Camila Montecinos, from the Chile office of GRAIN, an international NGO that works to support small farmers and social movements in their struggles for community-controlled and biodiversity-based food systems.

Transnational food companies “chose maize, soy and canola because of their enormous potential for contamination (by wind-pollination),” said Montecinos, one of the experts participating in the preliminary hearing on transgenic contamination of native maize at the Permanent Peoples’ Tribunal, an international opinion tribunal which opened its Mexican chapter in 2012 and will conclude with a non-binding ruling in 2014.

“When contamination spreads, the companies claim that the presence of transgenic crops must be recognised and legalised,” in order to pave the way for marketing the GM seeds, to which they own the patents, she said.

Mexico’s environment minister, Juan Guerra, has said that all available scientific information will be examined before a decision is made.

But that will not be easy. The National Confederation of Campesinos (Small Farmers), one of the main internal movements in the ruling PRI, has had an agreement with Monsanto since 2007 under which the company is to “conserve” native varieties.

Meanwhile, the Peña Nieto government still has not approved regulations for the format and contents of reports on the results of releasing GM organisms, and the possible threats to the environment, biodiversity, and the health of animals, plants and fish.

“For 18 years, corporations have been unsuccessful in convincing the people that their products are good. Maize is being used as a means of political and economic control. People need maize to be alive,” the ETC Group’s Mooney said.

The transgenic seeds on the market are herbicide-resistant Roundup Ready and Bt (for the Bacillus thuringiensis gene they carry for pest resistance) versions of cotton, maize, soy and canola. While they are legally grown in Canada, the United States, Argentina, Brazil and Spain, they are banned for example in China, Russia and the majority of the EU countries.

Recent studies published in the United States show that transgenic crops do not significantly increase yield per hectare, do not reduce herbicide use, and do not increase resistance to pests, in contrast to biotech industry claims.

“We are analysing what legal action to take against the new applications (to plant GM maize),” said Robles, of the Maize Defence Network.

IPS – Mexico – Ground Zero in the Fight for the Future of Maize | Inter Press Service

Pioneer Hi-Bred | Crop Insights: Soil Temperature and Corn Emergence

By Maria Stoll1 and Imad Saab2

Summary

Corn is a warm-season crop. Germination and emergence are optimal when soil temperatures are approximately 85 to 90 F. Cool conditions during planting impose significant stress on corn emergence and seedling health.

Corn seed is particularly susceptible to cold stress during imbibition. Warmer, moist conditions for the first 24-48 hours after planting can mitigate much of the cold stress.

In lighter-textured soils, spring nighttime temperatures can drop significantly below 50 F, even after warm days, inflicting extra stress on corn emergence.

High amounts of residue can slow soil warming and the accumulation of soil GDUs needed for corn emergence.

DuPont Pioneer offers product ratings such as stress emergence (SE) and high-residue suitability (HRS) scores to help growers manage for productive stands under stress or high-residue conditions.

Pioneer also offers industry-leading seed treatments that help protect seed from damage caused by multiple early-season pests.

Introduction

Successful corn emergence is a combination of 3 key factors – environment, genetics and seed quality (Figure 1).

Figure 1. Some critical environmental, genetic and seed quality factors that affect stand establishment.

Hybrid genetics provide the basis for tolerance to cold stress. High seed quality helps ensure that the seed will perform up to its genetic ability. Pioneer concentrates on selecting the best genetics for consistent performance across a wide range of environments and producing high quality seed. However, even with the best genetics and highest seed quality, environmental factors can still dictate stand establishment. Pioneer provides research-based advice that can help growers make informed decisions and better manage their field operations to maximize stands.

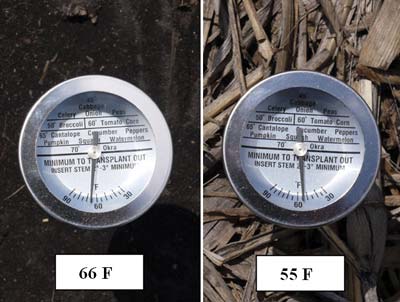

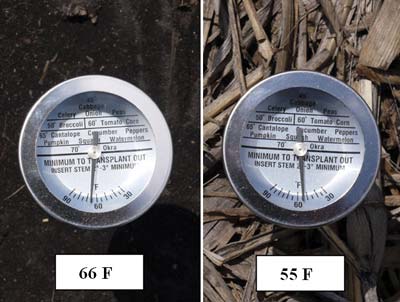

Soil temperatures at planting are a key environmental component of stand establishment. It is generally recommended that growers plant when soil temperatures are at or above 50 F. However, soil conditions after planting are also critical (Figure 2).

Figure 2. Low soil temperatures after planting greatly reduced stands at a stress emergence site near Eau Claire, WI, in 2011.

This Crop Insights discusses how the level and timing of cold stress affects seed germination and emergence and how growers can mitigate these stresses when planting in challenging environments.

Optimal Temperature for Early Corn Growth

Corn is a warm-season crop and does best under warm conditions. In North America, early-season planting typically puts stress on the corn seedlings. To help understand optimal corn growth, 3 hybrids of early, mid and late maturities were germinated in temperatures ranging from 59 to 95 F (15 to 35 C). Growth rates of both roots and shoots were measured. All 3 hybrids were averaged to determine the optimal temperature for corn growth. Both shoots and roots exhibited the fastest growth rate at 86 F (30 C) and continued to grow rapidly at 95 F (35 C), suggesting optimal seedling germination and emergence occurs at much higher soil temperatures than are common in most corn producing areas (Figure 3). Growers can expect much slower emergence and growth at the cool soil temperatures that are typical during U.S. and Canada corn planting.

Figure 3. Average early root and shoot growth rates for 3 hybrids under 4 soil temperatures ranging from 59 to 95 F.

Genetic Differentiation for Emergence in Cold Soils

Soil temperatures after planting are often a good indication of stress level, and stands may be reduced when average soil temperatures are below 50 F (Figure 4). DuPont Pioneer provides stress emergence (SE) scores for all North America commercial hybrids to help growers manage early-season risk. Choosing hybrids with higher SE scores can help reduce genetic vulnerability to stand loss due to cold soil temperatures.

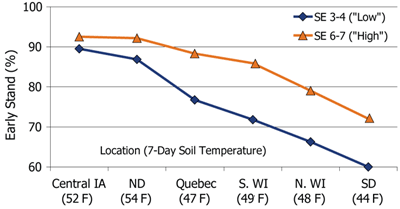

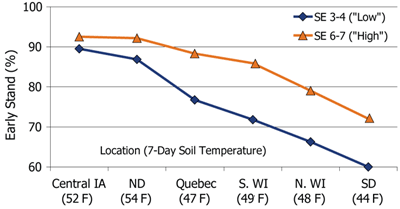

In 2009, a wide range of stress emergence conditions and soil temperatures were seen in the Pioneer stress emergence field plots. To demonstrate how stress emergence scores relate to stand establishment in the field, hybrids were grouped by "low SE" - those with an SE rating of 3 or 4, and "high SE" - those with an SE rating of 6 or 7.

Seventy low SE hybrids and 146 high SE hybrids were represented in the trials. Early stand counts for all hybrids within each group were averaged at each location. As stress level increased, both the low SE and high SE hybrids experienced stand loss. However, the hybrids with a SE score of 6 or 7 were able to maintain higher stands as compared to those with a low SE score (Figure 4).

Figure 4. Average stand establishment for high and low SE score hybrids in 6 stress emergence locations in 2009. Locations are sorted from least stressful (left) to most stressful (right) based on average early stand.

Planting date remains a critical management factor to help growers minimize the risks associated with suboptimal conditions for germination. Planting into cold, wet soils inflicts stress on corn seed emergence, as does planting just ahead of a cold spell. In some years, corn may be planted prior to a cold rain or snow, resulting in the seed sitting in cold, saturated soils (Figure 5).

Figure 5. Snowfall soon after planting imposes a very high level of stress on corn emergence due to seed imbibing chilled water or prolonged exposure to cold, saturated soils.

Timing of Cold Stress Impacts Germination

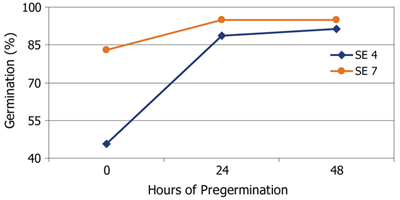

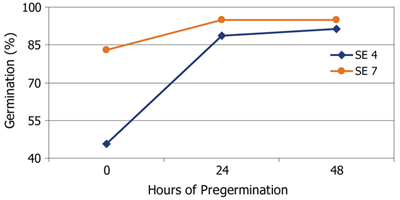

To help understand the importance of the timing of cold stress, 2 hybrids with SE scores of 4 (below average) and 7 (above average) were allowed to germinate in rolled towels for 0, 24, or 48 hours at 77 F (25 C). The hybrids were then subjected to a stress of melting ice for 3 days and allowed to recover for 4 days at 77 F (25 C). Hybrids were evaluated for the number of normal seedlings reported as percent germination (Figure 6).

Figure 6. Germination of 2 hybrids with stress emergence scores of 4 (below average) and 7 (above average) following imbibitional chilling induced by melting ice. Ice was applied immediately after planting (0 hours) or after 24 hours or 48 hours of pregermination in warm conditions.

Both hybrids showed significant stand loss when the cold stress was imposed immediately (0 hours). However, the hybrid with a higher SE score had a higher percent germination than the hybrid with a low SE score. Germination rates for both hybrids were greatly improved if allowed to uptake water and germinate at warmer temperatures for at least 24 hours before the ice was added.

Data suggests that planting just before a stress event such as a cold rain or snow can cause significant stand loss. The chances of establishing a good stand are greatly improved if hybrids are allowed to germinate at least 1 day in warmer, moist conditions before a cold-stress event. Also, choosing a hybrid with a higher stress emergence score can help moderate stand losses due to cold stress.

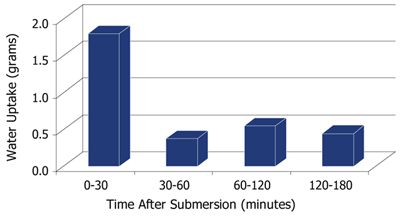

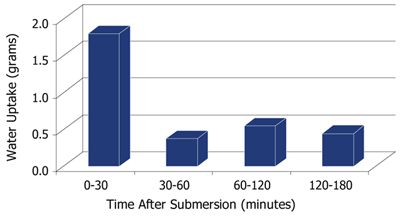

One reason why temperature during imbibition is critical to corn emergence is the fact that seed imbibes most of the water needed for germination very rapidly. To illustrate the rapid timing of water uptake, seed was submerged in 50 F water for 3 hours and weighed at intervals of 30, 60, 120 and 180 minutes to determine water uptake (Figure 7).

Figure 7. Amount of water uptake by corn seed during the first 3 hours after submersion in 50 F water.

The data show that seed imbibes the most water within the first 30 minutes after exposure to saturated conditions. If this early imbibition occurs at cold temperatures, it could kill the seed or result in abnormal seedlings. Growers should not only consider soil temperature at planting, but also the expected temperature when seed begins rapidly soaking up water. Seed planted in warmer, dry soils can still be injured if the dry period is followed by a cold, wet event.

Soil Temperature Fluctuations and Emergence

Growers are often able to plant fields with sandier soils earlier in the spring because they dry out faster than heavier soils. However, reduced stands after early planting have often been noted in sandier soils. Sandy soils are more porous and have lower water holding capacity than heavier soils. As such, they tend to experience wider temperature fluctuations, especially on clear nights with cold air temperatures.

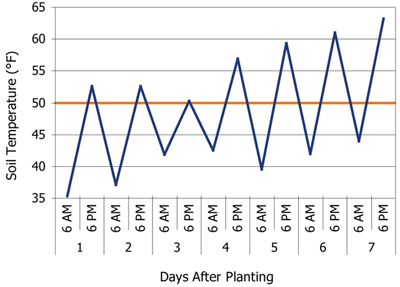

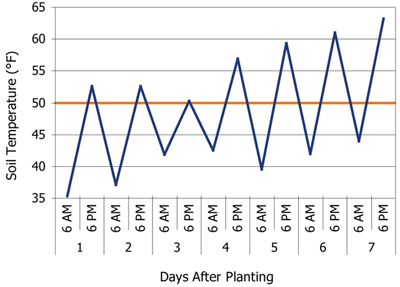

In 2009, soil temperatures were recorded at a 2-inch depth in a stress emergence location with sandy soils near Eau Claire, WI. Daytime soil temperatures reached acceptable levels for corn development (over 50 F) for the first week after planting. However, the early morning soil temperatures dipped to as low as 35 F, and on some days the soil temperature difference between 6 AM and 6 PM was close to 20 F (Figure 8). An average 25% stand loss was observed at this location, suggesting that day-night temperature fluctuation after planting can pose an added stress on germinating corn. Growers should be aware of expected nighttime temperatures when choosing a planting date.